In this article:

- Exactly how College loans Affect Bringing home financing

- Student loan Affect Credit ratings

- Cutting your Education loan Debt

- Other variables for finding Acknowledged getting home financing

If you find yourself a recently available college or university grad and you may aspire to end up being a citizen soon, you should know that student loan financial obligation make a difference to invest in a home by making it harder to get home financing. Some 83% of non-people say education loan loans try preventing her or him out-of to purchase a great domestic, according to the Federal Association off Real estate professionals (NAR).

But when you find yourself education loan payments causes it to be harder to store to possess a deposit into the a property, it cannot stop you from pursuing your perfect away from homeownership. The typical first-big date house visitors from inside the 2018 had $29,000 during the student loan loans, NAR profile. Read on to know the best way to perform student loan personal debt but still get approved for a home loan.

How Student education loans Affect Bringing home financing

Having a student loan, alone, isn’t a deal breaker loans in Golden Gate when it comes to providing a mortgage. Exactly what loan providers value is when personal debt you have (as well as your education loan obligations) you are going to affect your ability to repay the borrowed funds.

When you apply for a mortgage loan, the debt-to-money ratio (DTI) is amongst the circumstances lenders consider. DTI measures up the quantity of your own repeating month-to-month debt which have the overall monthly income. To determine the DTI, make sense all of your current repeated month-to-month debt (such as for instance lowest mastercard money, car loan costs and you will, however, education loan money) and you may divide they by the disgusting monthly money (the amount you have made ahead of taxation or other withholdings).

Imagine the graduate Maria have a monthly earnings out-of $step 3,five hundred and you will a whole repeated month-to-month loans out-of $step 1,two hundred. The girl DTI try 34% ($step one,200 separated by $3,500). Generally speaking, loan providers like to see a DTI from 43% otherwise reduced before giving your for a financial loan, and some lenders favor a beneficial DTI lower than thirty-six%.

What the results are if we create a month-to-month student loan payment off $393 so you can Maria’s loans stream? (This is basically the mediocre student loan percentage, according to the Federal Reserve.) Today Maria’s recurring monthly financial obligation is $step 1,593, broadening the girl DTI to forty five%-too much to track down a mortgage. More than half (52%) of non-residents throughout the NAR survey say the DTI try keeping them away from being qualified getting a home loan.

Student loan Effect on Fico scores

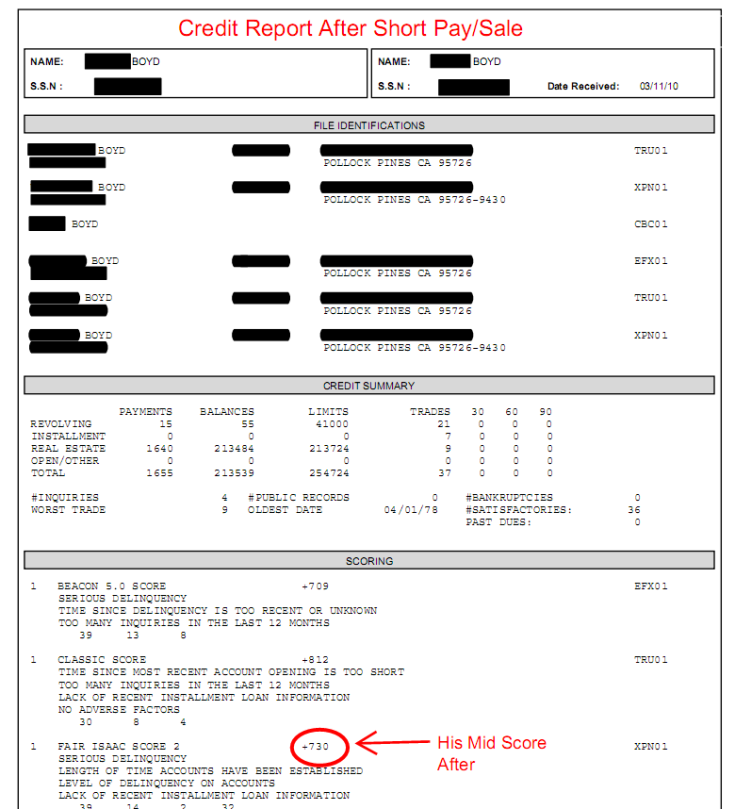

Your credit score are several you to loan providers used to assess debt records to see how creditworthy you are. It’s based on multiple products, including just how much loans you’ve got, what sort of loans you really have and you may whether you pay your own bills promptly. (If you aren’t yes exacltly what the credit score is, get the free rating out of Experian to ascertain.) A lot of people have numerous credit scores, that have differences according to the design used. Loan providers decide which to utilize when creating its choices, and you can generally explore a beneficial FICO Get ? whenever evaluating home loan apps.

Like all style of obligations, education loan obligations make a difference to their credit scores either absolutely otherwise negatively. Destroyed an educatonal loan percentage otherwise and come up with a later part of the commission commonly has actually a negative effect on your own results. Later payments stick to your credit history having 7 decades.

And also make student loan payments punctually monthly, likewise, might help improve your fico scores. Setting up vehicles money for the student loans will help always never ever skip a repayment, providing you satisfaction whilst potentially enhancing your borrowing.

Looking after your borrowing from the bank utilization proportion low is an additional treatment for increase your credit scores. Your credit utilization ratio reflects how much cash of readily available borrowing from the bank you happen to be in fact using. When you have an entire borrowing limit regarding $nine,000 to your about three playing cards and you can hold an equilibrium regarding $750 on every (otherwise $2,250 complete), your credit application rates was twenty five%. A decreased borrowing from the bank application speed reveals you might be creating an excellent employment out-of dealing with the debt. Typically, it’s required to keep your credit utilization speed less than 31%-the lower, the greater.